Published on:

8 min read

Retirement Ready: Crafting Your Ideal Financial Future

Preparing for retirement is more than just saving money; it's about crafting a financial strategy that aligns with your lifestyle goals. This guide will provide key insights and tips on how to achieve a secure and fulfilling retirement.

Understanding Your Retirement Needs

The first step to a successful retirement involves a clear understanding of your unique needs and goals. Start by evaluating your current lifestyle, estimating your future expenses, and considering where you might want to live. Will you travel, or do you plan to enjoy a peaceful life in your hometown? Analyze health care costs, housing, and leisure activities; these will significantly influence your savings requirements. Tools such as retirement calculators can help project the necessary amount you'll need to save based on your desired lifestyle. By gaining a thorough understanding of your future needs, you can craft an effective savings strategy designed to support your retirement aspirations.

Building a Diverse Investment Portfolio

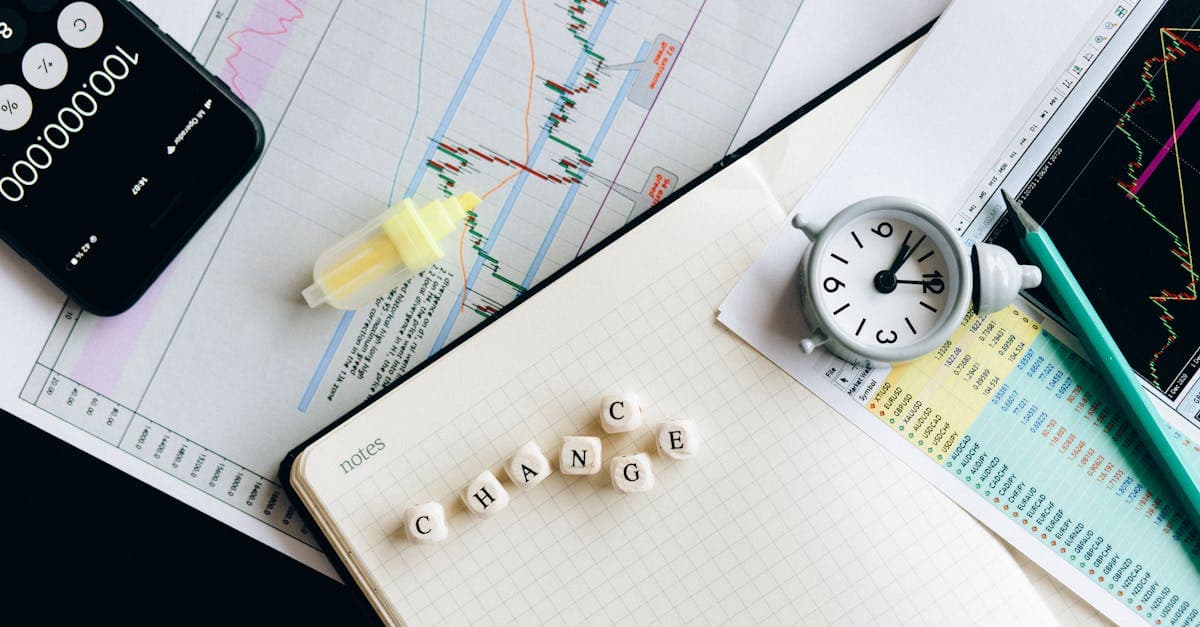

Investing wisely is crucial for building a nest egg that can sustain you during retirement. Begin by diversifying your investment portfolio across various asset classes—including stocks, bonds, and real estate. Each of these has its advantages and risks; thus, spreading your investments can reduce your risk exposure while maximizing returns over time. Consider your risk tolerance as you establish your portfolio: younger individuals often can afford to invest more aggressively, while those closer to retirement may prefer more stable, low-risk options. Regularly review and adjust your investments to align with market trends and changes in your financial goals. Smart investing is a cornerstone of a secure financial future.

Creating a Comprehensive Retirement Plan

A comprehensive retirement plan is essential for ensuring your financial readiness. Start by documenting your income sources—pensions, Social Security, and savings—and then define your withdrawal strategy. Consider using the 4% rule as a guideline for determining how much you can safely withdraw each year without depleting your savings. Additionally, it’s wise to factor in taxes, inflation, and unexpected expenses. Engage a financial advisor for professional insights and tailor your plan to meet your unique circumstances. A well-structured plan lays the groundwork for a secure retirement, providing clarity and confidence as you transition to this new life stage.

Conclusion

In conclusion, retirement readiness requires proactive planning and informed decision-making. By understanding your needs, investing wisely, and formulating a comprehensive retirement plan, you can design a financial future that aligns with your lifestyle goals. Start your journey today to secure the retirement you deserve.

Published on .

Share now!